Trust score

Tradeable Symbols (Total):

Year Founded:

Publicly Traded (Listed):

Bank:

Pros 👍🏻

Cons 👎🏻

XM Review; Touted as the next generation broker for online forex and commodity trading, XM is suitable for beginner and seasoned traders alike. Traders can get started with the trading software real account, or test the waters with a demo account platform with $100,000USD of virtual currency.

Highlights of this particular broker service include auto trading, no hidden fees or commissions and fast order executions, with 99.35% taking place in under 1 second.

Company Details

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments was established in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySec 120/10).

Trading Point of Financial Instruments Pty Ltd was established in 2015 and is regulated by the Australian Securities and Investments Commission (ASIC 443670).

XM Global was established in 2017 and is regulated by the International Financial Services Commission (000261/158).

Trading Point MENA Limited was established in 2019 and is regulated by the Dubai Financial Services Authority (F003484).

The platform boasts over 1.5 million clients with traders in 196 countries. The XM ethos is all about being big, fair and human. The company prides itself on things like excellent customer service and a personalised approach for every client, no matter their investment goals.

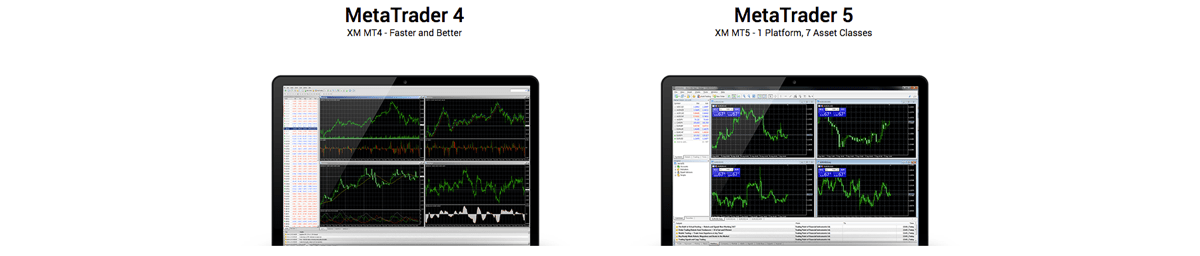

XM Trading Platform

XM offers 2 trading platforms which are accessible from both real and demo accounts. The multi-award winning MetaTrader 4 is predominantly a forex trading platform that supports stop, limit, market and trailing orders.

The MetaTrader 5 platform is a multi-asset trading platform which also offers access to stocks, stock indices and precious metals. Both platforms are available on Apple and Android devices, which makes for a smooth and easy-to-use mobile trading experience.

The trading area offers additional, optional tools, such as economic calendar or trade volume stats.

Assets / Markets

This broker has more than 1000 financial instruments which can be traded on the MT4/MT5 platforms and this includes Forex Trading, Stocks CFDs, Commodities CFDs, Equity Indices CFDs, Precious Metals CFDs and Energies CFDs.

Forex trading is available on over 55 pairs, including the major USD, GBP, EUR and JPY pairs.

XM does not offer binary options or cryptocurrencies.

Spreads & Commission

Spreads vary depending on the kind of account opened. It’s possible to open a Micro Account, Standard Account and XM Zero Account. The minimum spread across all accounts is 0.1 pips, and the average spread for a major pair such as EUR/USD is 0.1 pips.

XM operates a strict “no hidden fees or commission” policy. As such, commission is only given for XM Zero accounts. XM covers all transfer fees and same-day withdrawals are guaranteed.

Leverage

Depending on the instrument, the leverage can range from 2:1 to 30:1. This is completely flexible and XM offers its clients the chance to manage their own leverage risk. Margin requirements remain constant throughout the week and never widen at weekends or at night.

This leverage applies to clients registered under the EU regulated entity of the group.

XM Mobile Apps

XM is available on a number of Android and Apple devices, including Apple iPhone, Apple iPad and Android tablets and Android phones. Login is super-easy and can be done via fingerprint. You can download their apps from the Apple App Store or the Google Play Store.

They are both fully functional and allow for monitoring and trading on-the-go. The desktop platforms for PC and Mac both support one-click trading.

Payment Methods

In line with conventional KYC regulations, users need to provide a colour copy of an official identification document such as a passport or a driver’s license. They also need to provide a recent utility bill dated within the last three months as proof of address.

Once registered, the minimum deposit amount is $5 for Micro, Standard and Zero accounts.

Deposits can be made using most major credit cards, electronic payment methods, wire transfer, local bank transfer and more.

Deposits can be made in any currency and it will be automatically converted into the currency you select as your base currency when opening the account.

All withdrawals are processed in 24 hours and there are no fees to take your money out of your eWallet.

Demo Account

XM excels in its demo account offering. Users can set up a demo account with just a few details and then get trading with a virtual balance of $100,000USD. The XM demo account is unique in that it offers exactly the same trading conditions as the real thing.

There are no time limits on how long you can use your demo account.

Bonus Deals And Promotions

XM also offers a free VPS (virtual private server) service to help increase the speed of trades. This VPS is accessible from anywhere and available 24/7. They claim to eliminate downtime and are available across the globe.

More information regarding who can request the XM VPS can be found on the VPS page at XM.

XM are also offering commission and fee free withdrawals and deposits.

As an EU regulated brand, XM comply with the ESMA ban on bonuses, and the $30 deposit bonus is no longer available to EU traders.

Regulation And Licensing

As noted above, XM Group has a range of brands covered by different regulators.

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments was established in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySec 120/10).

Trading Point of Financial Instruments Pty Ltd was established in 2015 and is regulated by the Australian Securities and Investments Commission (ASIC 443670).

XM Global was established in 2017 and is regulated by the International Financial Services Commission (000261/158).

Additional Features

One of the biggest perks available on the XM platform is the wealth of training and educational materials available. The platform hosts regular webinars aimed at newcomers and seasoned professionals alike.

The platform is inherently social, encouraging users to learn from their team of instructors. The company also published research and technical analysis.

XM Account Types

There are four levels of trading account, Micro, Standard and Zero. All accounts allow up to 200 open/pending positions per client.

- Micro Accounts: Micro accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and can get started with a minimum deposit of $5USD. 1 micro lot is 1,000 units of the base currency.

- Ultra Low Accounts: XM Ultra Low Accounts, can use EUR, USD, GBP, AUD, ZAR, SGD as the base currency and traders will require a minimum deposit of $5 USD. 1 Standard Ultra lot is 100,000 units of the chosen base currency, whereas, 1 Micro Ultra lot is 1,000 units of the base currency. XM Ultra Low Accounts are not applicable to all entities of the group.

- Standard: Standard accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and traders can get started with just $5USD. 1 standard lot is 100,000 units of the chosen base currency.

- Zero Accounts: Zero accounts can use USD, JPY and EUR as the base currency and traders will require a minimum deposit of $5USD. Like the Standard account, 1 standard lot is 100,000 units of the chosen base currency. Zero accounts are not applicable to all the entities of the XM Group.

Benefits

XM offers a full-service education package on forex, ideal for those making their first steps into trading.

However, this isn’t at the expense of the more seasoned professional, who also have access to expert analysis and unparalleled tracking tools. As a company that prides itself on solid customer service, their users are well-served with support available in many different languages.

Drawbacks

While the support may be strong, some users dislike that customer support is only available Monday to Friday. Another disadvantage is the lack of diversity between the different account types makes for a less personalised feel.

Other brokers offer more a distinct offering in their accounts, but the Micro, Standard and Zero accounts are almost identical. And finally, PayPal deposits are not currently supported, which can be problematic for some.

Traders from certain regions are also forbidden to open an account due to licensing laws, these include Canada and the United States.

Trading Hours

In line with worldwide Forex market hours, XM is available 24 hours a day. For phone trading, the XM trading hours are Sunday 22:05 GMT through to Friday at 21:50 GMT.

Contact Details / Customer Support

The easiest way to contact XM is through their live chat feature found on the contact page of their website.

You can also email support on: support@xm.com

or call on +357 25029933.

Safety And Security

There are no obvious security concerns with the website. Users are required to confirm their email address in order to open a demo account but signing up for email updates is not a requirement. In order to open a trading account, identification documents are required.

According to the company privacy policy, XM has organisational procedures in place to ensure that personal data is kept secure.

Overall Verdict

XM offers a comprehensive broker service to traders of all levels. Whether you are just starting out and learning the ropes, or if you’re a seasoned trader looking for a reliable and efficient platform, XM is a solid choice.

Despite the shortcomings with the different account options, the platform is easy to use and simple to navigate.

Accepted Countries

XM accepts traders from Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use XM from United States, Canada, Israel, Iran, Argentina.

Reviews

There are no reviews yet.